The short answer could be: now. However, everyone should consider their knowledge and the global economic situation before deeply diving into investing. So, when is the best time to invest personally and economically?

The best personal time for investment

We advise you to follow the main simple steps before putting your earned money into an investment vehicle.

Firstly, ensure you have an emergency fund, which means do not put all your money into investing. Secondly, you should figure out your budget and your risk tolerance. If investing in the financial markets might sound highly complex, we know the easier and more predictable way of investing and earning money regularly. It is P2P lending. Here are some reasons why:

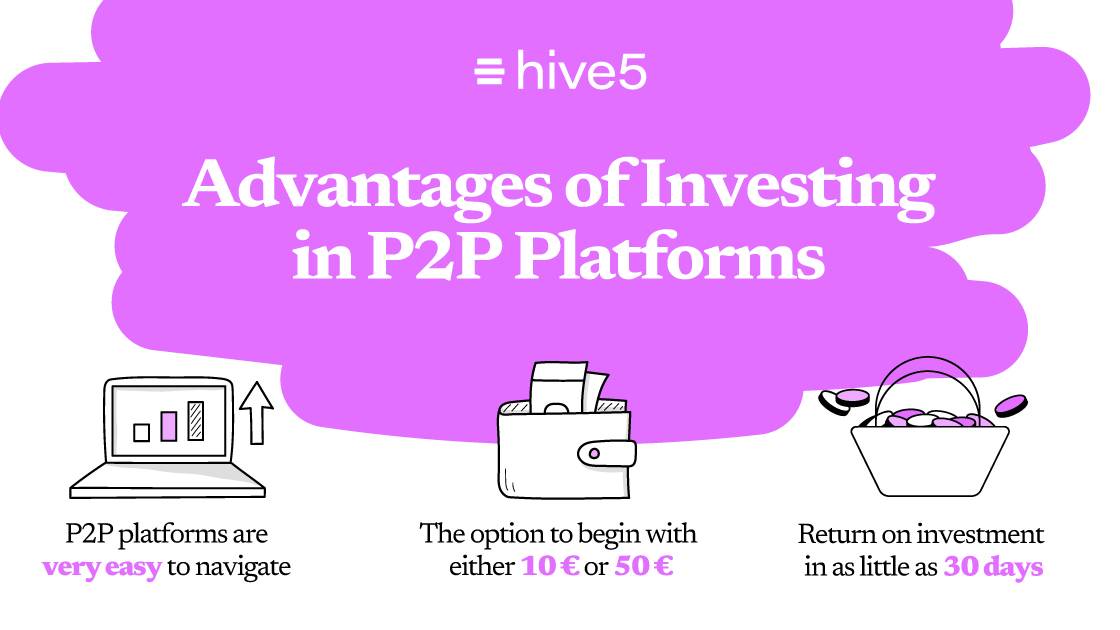

1. It is simple. Online P2P platforms are very easy to navigate, even for beginners

2. You can invest for a short period; for instance, on hive5 you can earn your first investment return in less than 30 days

3. You do not need to put in a huge amount of money at once; you can start from 10 Eur or 50 Eur

Even though there's no one-size-fits-all investment strategy, the primary strategy that must always be followed is to diversify your money and have an emergency fund in case any unexpected situation may appear.

If you have researched the trustworthy P2P platform, checked who owns the company and ensured it provides the buyback guarantee, you can start investing and make it a monthly routine that will serve you well for decades.

A smart investment for companies

Moreover, recently we have received much positive feedback from companies investing on hive5. They are satisfied with a simple registration process. Consequently, there is no bureaucracy, no documents, and long processes. One of our clients shares a positive experience with earning 600 Eur per month, which pays off the cost of one cars leasing.

Thus, today is the best time to invest, as companies can earn money from the account instead of keeping it in cash.

The current global situation

Recently the S&P 500 has gotten out of the bear market territory. Even though it is a positive sign, economists think it could take years to stabilise the market. However, investing in consumer loans on trustworthy P2P platforms could steady investment portfolios in this shaky market.

Furthermore, the predictability of returns is one crucial way P2P loans and the stock market differ. Unlike the stock market, P2P lending gives investors the expected returns and repayment schedule. You choose the period and annual return.

Luckily, now investing in P2P loans offer relatively high returns of 10% and even 14% on hive5, in contrast to the stock market or bonds, which are typically said to offer an annual lower return on average.

Investing on P2P platforms objectively is a very wise choice nowadays.