October was a productive month for hive5, the platform has reached significant portfolio growth, and key business development across the Hive Finance Group. Loan volume funded in October increased by 23% compared to September.

Let’s take a closer look at the main business highlights for October:

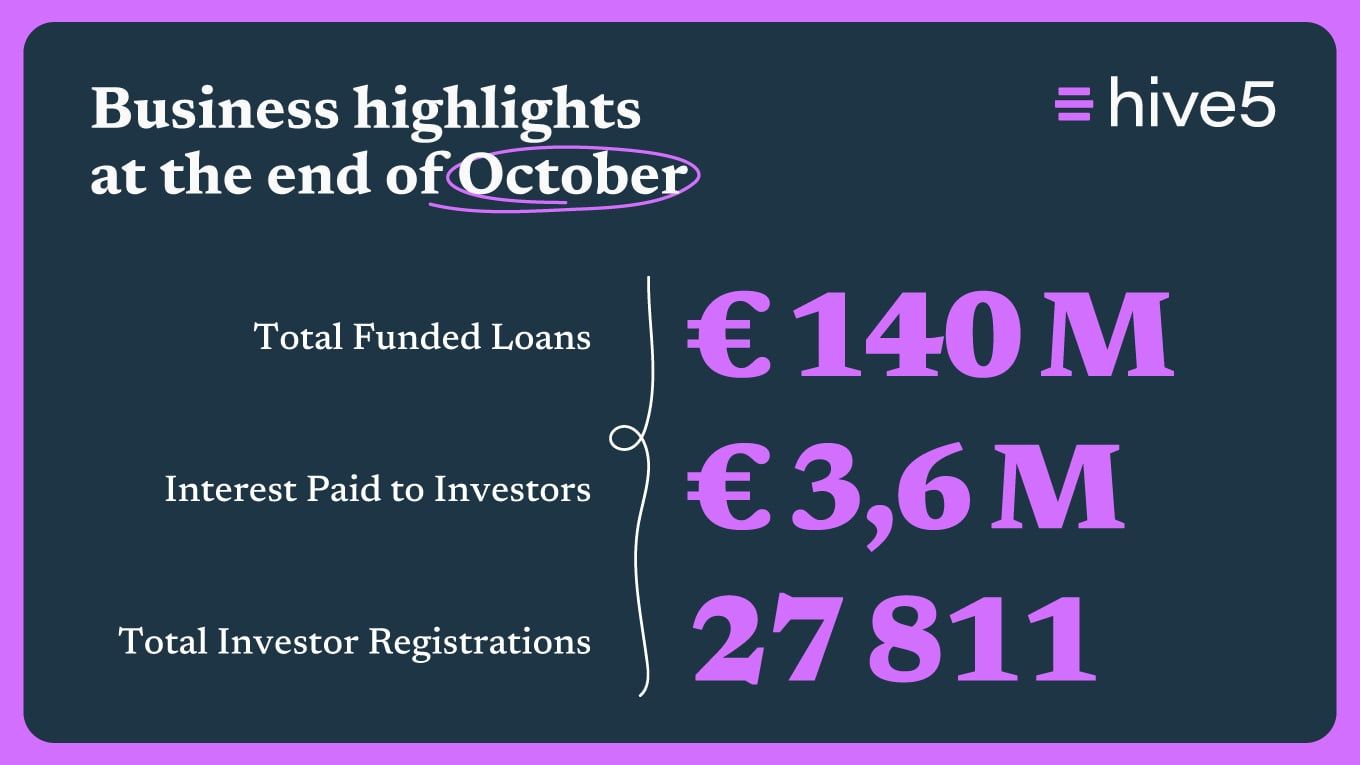

- Total loan volume funded since inception: 140 179 245 EUR

- Loan volume funded in October: 8 009 023 EUR (vs 6 494 611 EUR in September)

- Number of loans originated: 12 130

- Average nominal interest rate: 13%

- Total registered investors: 27 811

- Interest Paid to Investors: 3.6M EUR

This notable 23% increase in loan volume was mainly driven by seasonal trends and a broader loan supply within the Hive Finance Group. We’re pleased to see that investors are actively responding to the expanding and high-quality offering on the hive5 platform.

In October, we also welcomed Firmeo, a business lending company owned by Hive Finance Group in Poland. The company started to offer a new asset class - business loans. This addition, combined with strong seasonal performance, helped drive the higher loan volume.

It is important to remind, that last month, we introduced Google 2-Factor Authentication (2FA) - an additional layer of protection that keeps your hive5 account even more secure. If you haven’t done it yet, we strongly encourage you to activate 2-Factor Authentication today and add an extra layer of protection to your hive5 account.