Investing habits are constantly changing and shaped by macroeconomic factors, geopolitical situations, technological advancements, etc. If you want to invest your savings wisely, it is very important to repeatedly break down the crucial trends in the global investment market and analyse the broader economic climate.

Stock Market Trends

The stock market in 2024 exhibits a slight shift. The industry titans Google, Apple, and Tesla continue to control big premiums due to their market influence and consistent performance, often overpowering the broader indices*. However, an emerging trend is the growing attractiveness of mid-and-small-cap stocks. Historically underperforming since 2015, these stocks now present a significant discount, trading at 19.5 times earnings compared to their 20-year average of 21.3 times**. This number suggests a potential for substantial growth, especially as these companies stand to benefit from eased policies and improvements in the global supply chain post-pandemic.

The Revival of Bonds

Recently, the bond market has witnessed a rebirth of interest. Following a series of rate hikes by the Federal Reserve aimed at reducing the growth of inflation, bonds are now forecasted to yield between 4.8% and 5.8% annually over the next decade**. This improvement from previous expectations marks a renewed opportunity for long-term investors seeking stable income in their portfolios.

Global Economic Influences

The current global economic environment is highly complicated. Despite a tentative easing of inflation and a positive wage adjustment, geopolitical tensions - especially recent events in the Middle East - have introduced instability, impacting commodity markets like oil***. These developments require investors to maintain an adaptable investment strategy, emphasising the importance of real-time, informed decision-making.

The AI Revolution

The transformative impact of artificial intelligence (AI) continues to be a significant theme in 2024. AI's integration across various sectors, from finance to healthcare, illustrates a revolutionary shift in operational capabilities and efficiency****. Investment in AI-driven companies has notably increased, with industry leaders like Nvidia and Microsoft experiencing substantial gains. This trend underscores the potential of AI as a key element in future growth and investment strategies.

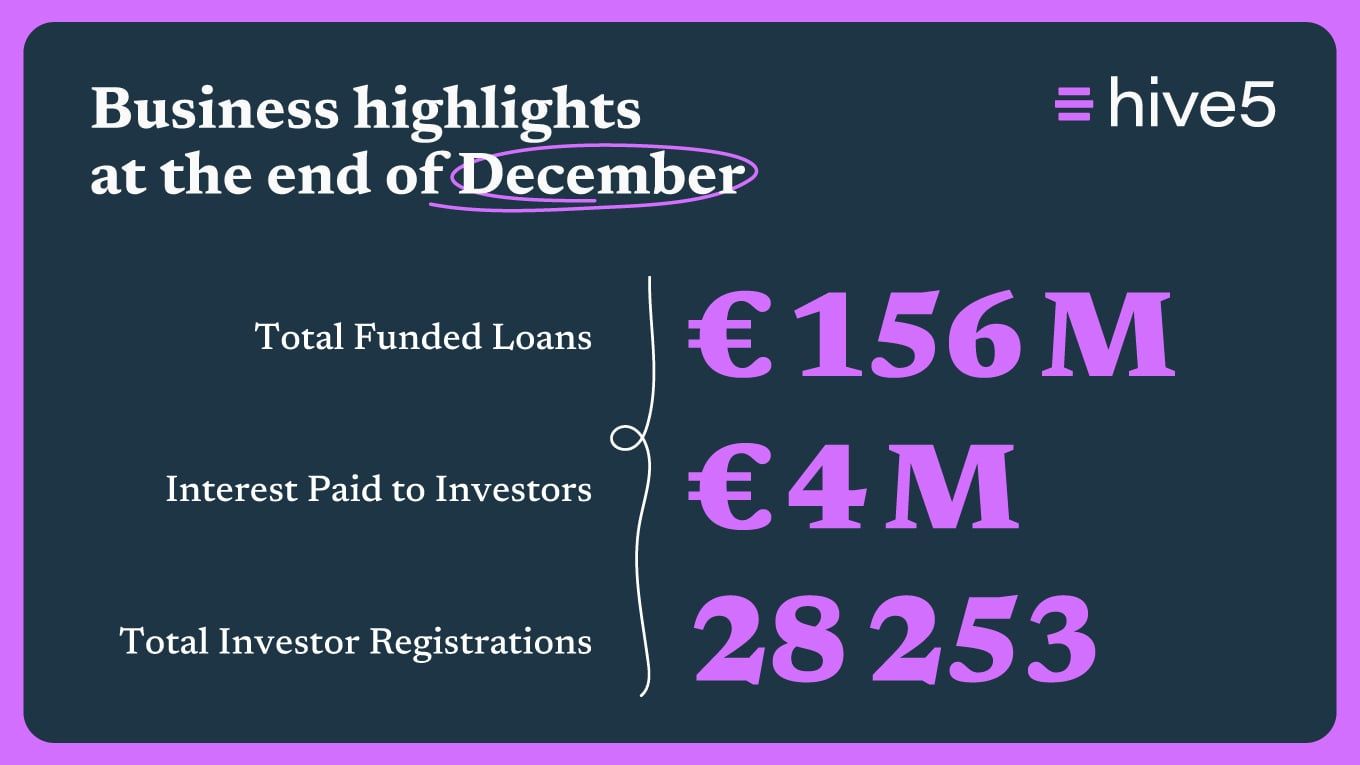

Alternative Investments: P2P Platforms

Alternative investments are gaining more and more interest, particularly P2P platforms. In an era where traditional investments encounter volatility, P2P marketplaces like hive5 offer a compelling mix of regular income and liquidity. Investors looking to diversify their portfolios and reduce risks associated with market instabilities tend to invest on P2P platforms. Investing in consumer loans can stabilise investment portfolios in uncertain times. P2P platforms, like hive5, offer regular income and easy liquidity, making it a reliable choice for investors seeking security.

Sources:

*https://www.forbes.com/advisor/investing/top-investing-trends-2024/

**https://advisors.vanguard.com/insights/article/series/market-perspectives#united-states

***https://edition.cnn.com/2024/04/19/investing/premarket-stocks-trading-stocks-fed-oil/index.html

****https://edition.cnn.com/2024/04/08/investing/premarket-stocks-trading/index.html