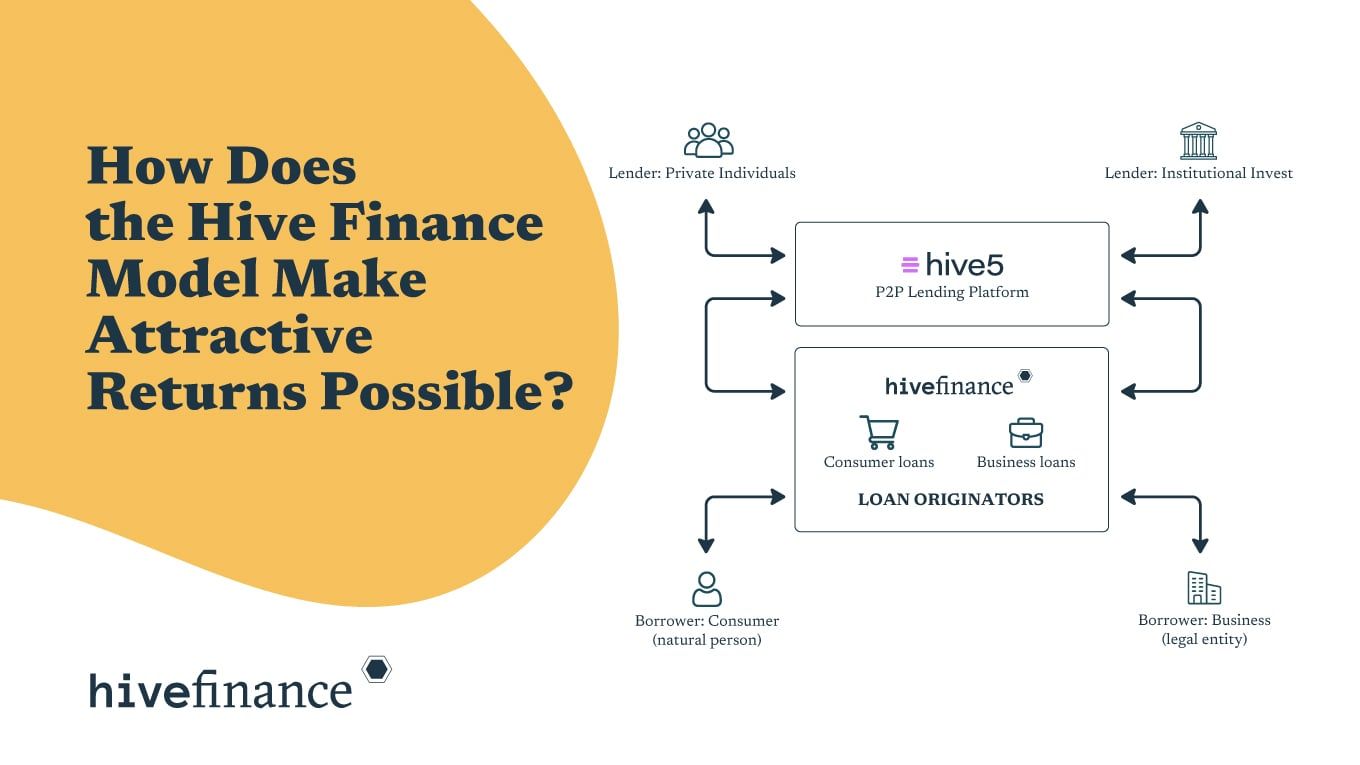

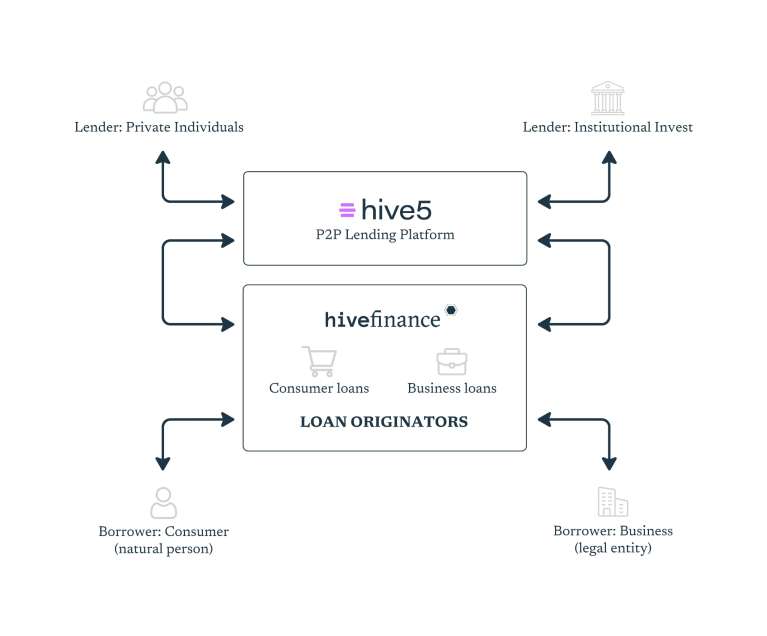

If you’ve ever wondered how hive5 can offer loans with interest rates of 13%, while investors and the platform still make a profit, today we’d like to take a closer look at how this model actually works. The answer lies in the business model, the markets we operate in, and the type of financing we provide.

As you already know, hive5 belongs to Hive Finance Group, a financial ecosystem that owns and operates its own loan-originating companies. This structure allows hive5 to connect investors directly with a transparent, profit-sharing model.

Loan Originators Earn High Returns

Our group-owned loan originators operate in market segments that are underserved by banks, such as consumers and SMEs who need fast, short-term, flexible financing. These loans are typically short, often weeks or months rather than years, and are priced to reflect higher risk and rapid decision-making. Usually, borrowers value speed and access, not just price. For many, the cost of waiting for a slower process is higher than paying a higher interest rate. This model isn’t new. It has been used for decades by micro-lenders, digital SME financiers, and fintech credit providers across many countries.

Loan Originators Pay a Small Fee to Hive5

When loan originators list their loans on hive5, they pay a small marketplace fee to access investor funding. This is sustainable because loan originators maintain healthy margins on their lending operations, while hive5 provides scalable and diversified capital at a competitive cost compared to traditional financing. In other words, the marketplace model makes funding more efficient without relying on institutional lenders.

Investors Receive a Strong Yield

Investors on hive5 earn 12–16% annual returns, depending on the loan type and market. These returns are available because hive5 works in lending segments that naturally carry a little bit higher risk and therefore offer higher yield potential. Traditional banks operate within more regulated, standardised frameworks. Alternative lenders can complement the market by providing faster and more flexible financing to businesses that need it. Through hive5, investors gain exposure to this dynamic segment and benefit from margins generated by specialised loan originators.

Hive Finance Group Retains the Lending Profit & Marketplace Fee

As a result, in this business ecosystem, loan originators earn strong returns from their lending operations, hive5 earns a small fee for providing the marketplace infrastructure, and investors receive an attractive share of the overall yield. As a result, the Hive Finance Group retains the remaining lending profit and marketplace fee; thus, the group can grow sustainably, expand into new markets, and continue to improve the platform.

To Sum Up

This business model creates a transparent and sustainable system where borrowers receive fast and flexible financing, investors earn strong returns, and the Hive Finance Group grows through efficient operations