In a short time, the companies within the Hive Finance Group have achieved what many take years to reach – consistent revenue growth and operational profitability. The past two years have been marked by rapid expansion, disciplined execution, and a clear shift from building foundations to scaling sustainably.

Reflecting this progress, the 2022–2024 financial report presents consolidated results of all Hive Finance Group companies: Hive5 marketplace, d.o.o., Argentum Capital, Sp. z o.o. (brand name “Ekspres Pożyczka”), Nectar Capital S.L. (brand name “Finjet”) and Hive Finance UAB (holding company).

Let’s sum up the most important highlights:

Strong Revenue Growth

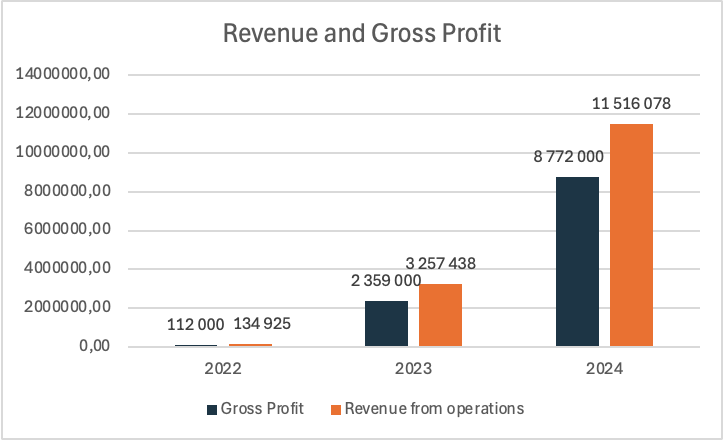

The group's revenue from operations increased from 135K EUR in 2022 to over 3.2M EUR in 2023 and further to 11.5M EUR in 2024. This impressive +2314% growth in 2023 and +255% in 2024 shows the group’s successful expansion into new markets and strong loan demand across hive5 platform.

Gross profit shows strong growth:

-

2022: 112K EUR

-

2023: 2.36M EUR

-

2024: 8.77M EUR

This steady revenue rise emphasizes the stability and maturity of the business model, something every long-term investor values.

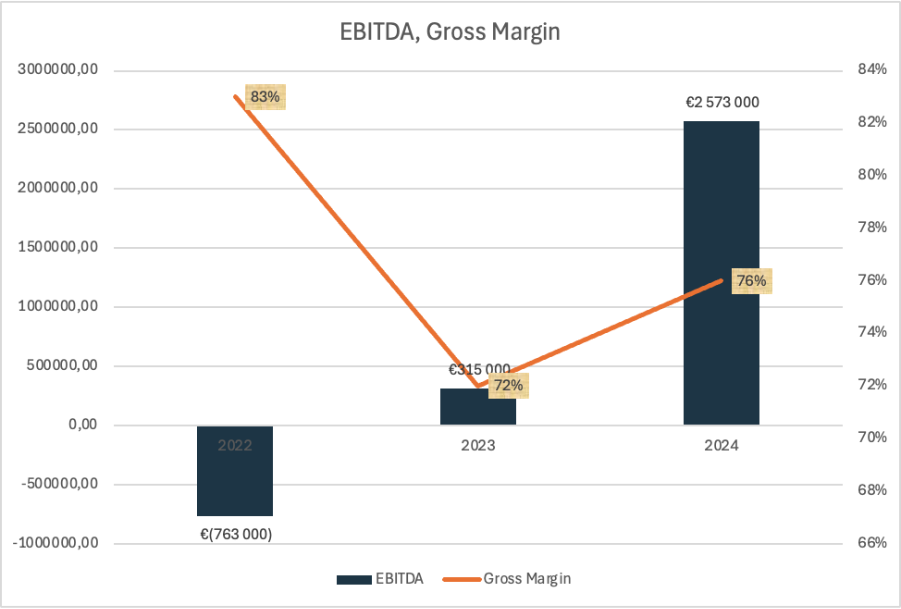

Operating Efficiency and Profitability

It is important to highlight a critical milestone reached in 2024: the Hive Finance Group of companies became EBITDA-positive, with 2.57M EUR in EBITDA, up from a negative 763K EUR in 2022.

Operating expenses have grown as the company expanded, but they remain proportionate to revenue and are a sign of controlled scaling. Similarly, loan loss provisions and depreciation increased, which reflects a growing loan portfolio, which is a healthy signal for our investors.

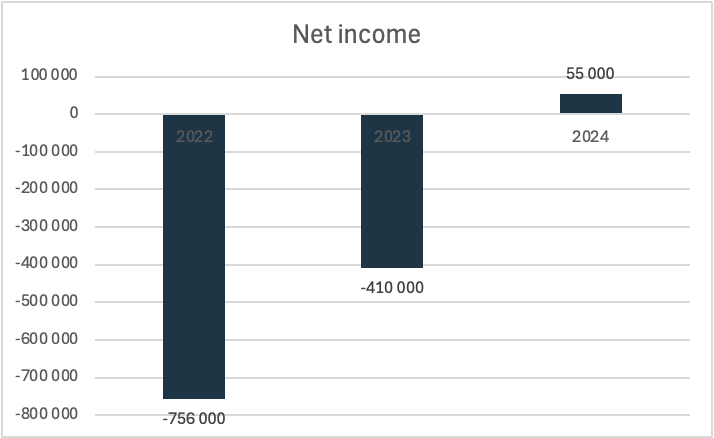

Turnaround to Profitability

After operating at a loss in previous years, we have reached profitability in 2024, with a net income of 55K EUR, compared to -755K EUR in 2022 and -410K EUR in 2023. This positive net result is a strong indicator of long-term financial sustainability and execution capacity. Moreover, the equity position is strengthening, reflecting improving profitability and disciplined capital management.

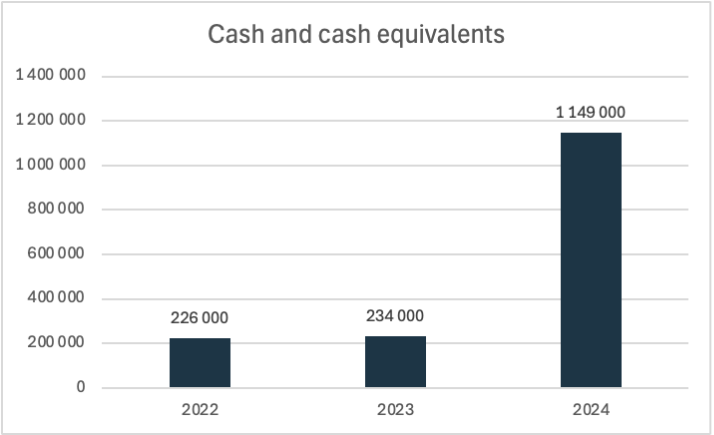

Moreover, the liquidity has significantly improved. Cash and cash equivalents rose from 225K EUR in 2022 to 1.14M EUR in 2024, while financial expenses decreased by nearly 65%. This suggests not only better capital management but also more favourable financing terms or internal optimisation.

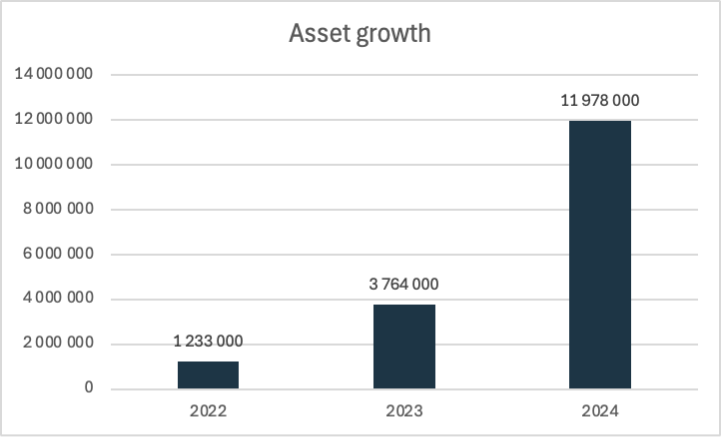

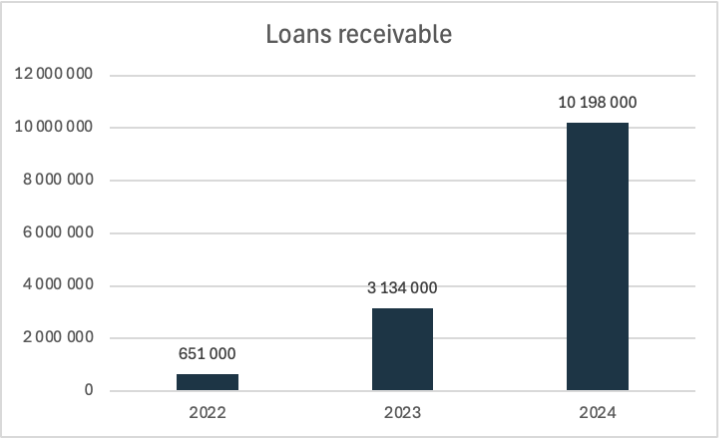

Asset Base Expansion

In just two years, total assets grew from 1.23M EUR in 2022 to 11.98M EUR in 2024, which is a nine times increase. This explosive asset growth comes largely from:

-

Loans receivable: from 651K EUR in 2022 to over 10M EUR in 2024

-

Deferred tax assets and property/equipment also increased

This positions the group well to support further origination volumes without immediate external capital needs.

The Importance for Investors

This report confirms that Hive Finance Group has reached a crucial turning point. The group's ability to scale operations, reduce financial costs, and achieve profitability – all while maintaining growth in assets and revenue – sends a clear message to investors: Hive Finance Group is a fast-growing and highly scalable business.

Investors could expect that after positive business results, we can focus on better credit scoring, better risk-adjusted returns, and an increasing ability to self-finance or operate with diversified funding strategies.