Since the end of February, our loan originator, FinJet, has started loan issues in Spain. Since its launch, the company has demonstrated remarkable progress, which could mean a bright future. Let's look closer at FinJet's early results and what it means for investors on hive5.

Early Figures

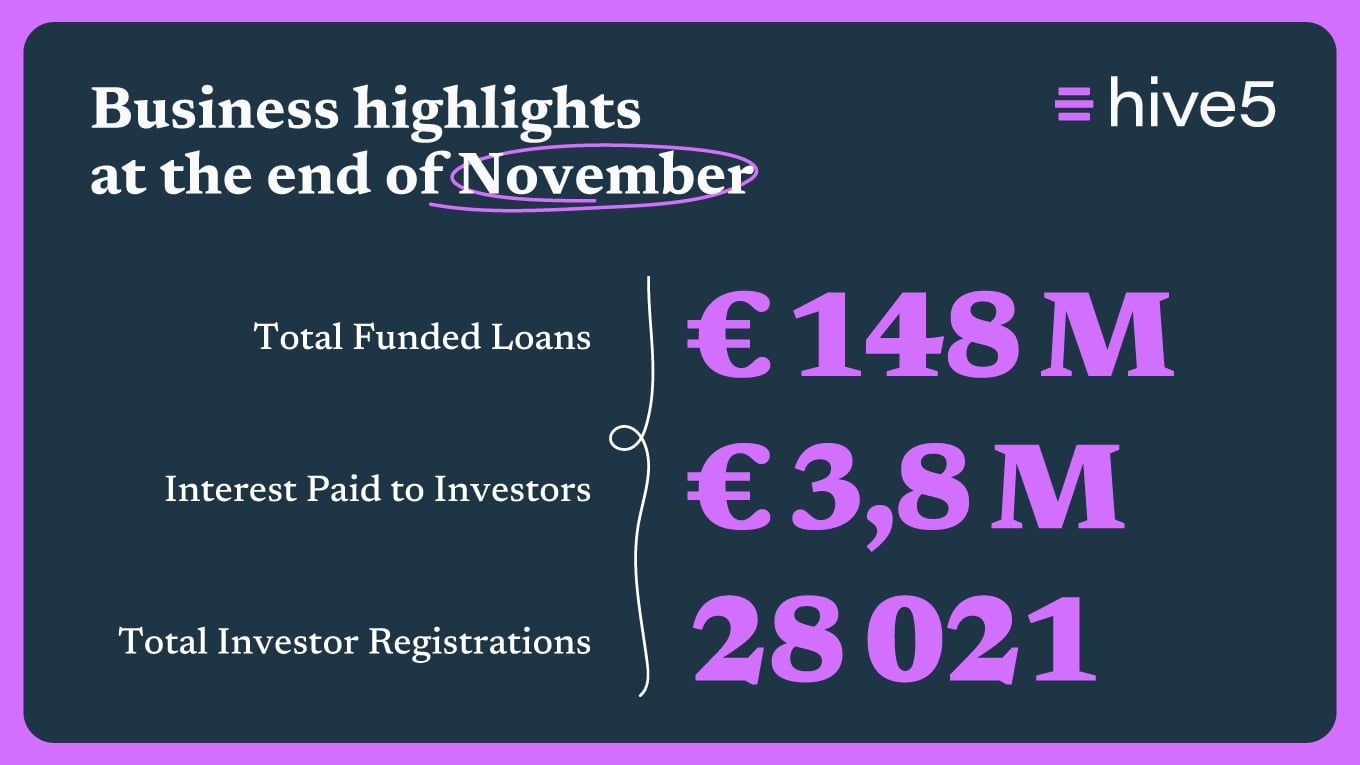

Since beginning its operations, FinJet has received almost 22,000 leads. This significant interest highlights the demand for FinJet's lending services and its ability to attract potential borrowers. After carefully assessing the borrowers, the company has issued 1,360 loans and collects a substantial cumulative portfolio of 126,000 Eur. These numbers reflect a strong market entry and highlight FinJet's operational efficiency.

Although this is just the beginning, FinJet has set an expected default rate of 11%, derived from detailed analysis and forecasting. This level of transparency and forward-thinking is essential for building trust with investors and underlines FinJet's commitment to sustainable growth. Moreover, hive5 investors have already shown confidence in FinJet's potential by investing around 81,000 Eur; it is important to note that 100% of loans are protected with a buyback guarantee.

Risk Management and Plans

At the core of FinJet's early results is its dependence on sophisticated data analysis and credit risk management. By using market-leading scoring providers, the company ensures a high level of decision-making accuracy and positions FinJet as a forward-thinking player in the market. Integrating this mature database for quality assessment is critical for navigating the competitive demand in Spain.

FinJet issues personal short-term loans with a 30-day term ranging from €100 to €500, which is just the beginning. The Spanish team plans to expand its portfolio to include instalment loans later this year. This expansion strategy will give the flexibility needed to grow and develop its lending services.

A Future with Hive5

FinJet's promising start is a success story for our group of companies and community of investors. As FinJet continues to grow and expand its offerings, investors on hive5 can look forward to diverse investment opportunities that combine attractive returns with a commitment to risk management. Our team believes in FinJet's potential for a successful future and is proud to be part of this journey.

Don’t miss out on investing in short-term loans and renew your automatic investment strategy on the platform.