Investing can be a thrilling journey towards financial independence, but it always has risks. It is no secret that the key to successful investing lies in diversification. This strategy involves spreading your investments across various asset classes to minimise risk and increase returns. However, the genuinely diversified portfolio usually doesn't concern only different asset classes.

Exploring Different Assets and Markets

The most common investment type is stocks. However, it is just one piece of the puzzle. Diversification encourages us to look beyond the stock market and consider other asset classes, such as bonds, exchange-traded funds, real estate, cryptocurrency, and P2P investment platforms. These diverse options offer a broader spectrum of opportunities and can help balance the ups and downs of the market.

Finding the investment type and one market that suits you best may become a comfortable decision. However, a diversified portfolio should also have an international flavour. Investing globally allows you to tap into different economies, industries, and currencies. It safeguards against regional market downturns and offers the potential for significant gains when markets thrive elsewhere.

The Role of Alternative Investments

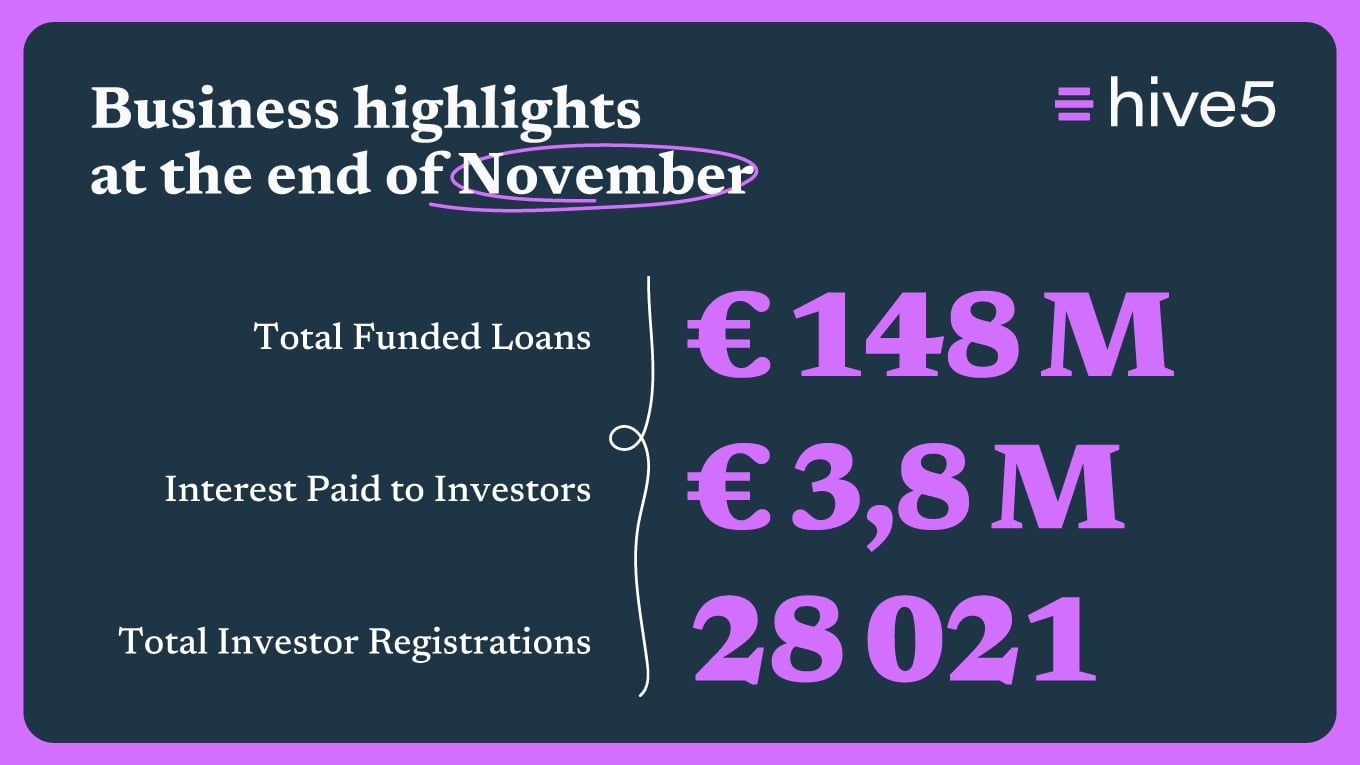

Even though P2P platforms are called alternative investment types, unlike cryptocurrency, P2P platforms offer one of the most predictable investment returns, especially marketplaces that provide a buyback guarantee, such as hive5. Additionally, investors can find different markets and types of loans on one P2P platform. Accordingly, on hive5, you can invest in the Lithuania and Poland markets. Soon, we're excited to announce that investors will have the opportunity to explore one more market. Moreover, you can also invest in personal or business loans on hive5, which gives you more opportunities for a truly diversified portfolio.

Conclusion: The Power of Diversification

Ultimately, a diversified portfolio isn't just a collection of investments; it's a strategic approach to wealth-building that can lead to bigger rewards and a more secure financial future. Hence, take the time to carefully consider how you can diversify your investments and watch your portfolio thrive.