In 2025, we focused on strengthening the foundations of Hive5 and Hive Finance Group. We prioritised stable performance, stronger governance, and continued upgrades to our risk management framework — with a long-term approach to reducing funding costs.

“Our focus has been building a business investors can rely on — with clear governance, transparent reporting, and risk discipline at the core. Consistency is what earns trust over time.” — Aurimas Kačinskas, CEO, Hive Finance Group

This approach shaped every major decision we made this year. Below is a look back at the milestones that defined 2025 and the steady focus we will carry into 2026.

2025 in review: stability, transparency, and operational consistency

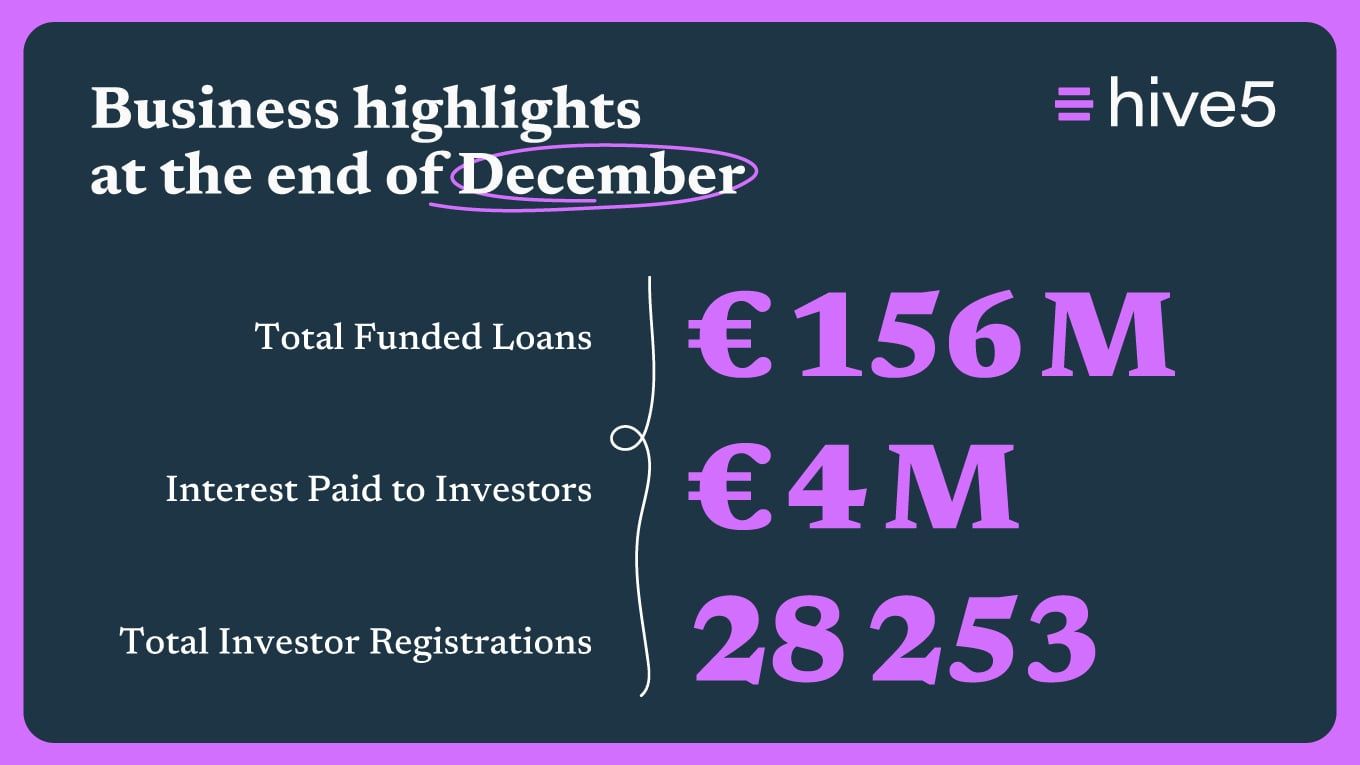

A strong marketplace is built on consistent performance. Throughout the year, Hive5 maintained stable investor activity and a healthy flow of new loans — even during seasonally slower periods. In November alone, the platform funded €7.86M in loans, bringing total funded volume since inception to €148.0M, with 28,021 registered investors and €3.8M in interest paid out to investors.

Strengthening governance and leadership

In 2025, we continued building a more structured organisation that helps a financial group make better decisions, manage risk more effectively, and communicate with clarity.

For investors, these steps matter because they support:

-

more disciplined risk management,

-

faster, more consistent decision-making.

A stronger shareholder base: Hive Finance Group joins Ruptela Group

One of the most important milestones this year was the shareholder change that brought Hive Finance Group into Ruptela Group — a well-established international business with in-house technology development and global scale.

Following the transaction, Ruptela Group now holds 35% of Hive Finance, with the remaining 65% held by the main shareholder, Andrius Rupšys, who continues to lead the company’s strategic direction.

This step supports what we’ve been building all year: stronger governance, higher transparency, and risk management maturity — backed by a more robust organisational framework and technology-driven mindset.

Expanding lending capabilities

Firmeo launches on Hive5

In October, we introduced Firmeo on Hive5 — a business lending company owned by Hive Finance Group — launching with €100,000 in 6-month business loans offering a 13% annual return to investors.

Firmeo expands our capabilities in SME lending in Poland, with a fully online process and fast credit decisions. Loan sizes range from PLN 10,000 to PLN 500,000, with repayment terms between 3 and 12 months.

Credilink has started issuing loans in Romania

In September, Credilink issued its first loans in Romania — officially launching operations in a regulated market we worked hard to enter, and already issuing our first 1,000 loans.

What investors can expect in 2026

Our goal for 2026 is to continue building a marketplace that earns trust through consistency.

“In 2026, our focus is execution: improving operational efficiency, upgrading risk monitoring, and strengthening reporting — while working to reduce funding costs responsibly. We want investors to see progress not only in results, but also in clarity and predictability.”— Aurimas Kačinskas, CEO, Hive Finance Group

Here’s what that looks like in practice:

1) Improving performance metrics through operational efficiency

In 2026, we plan to further streamline processes across origination, monitoring, reporting, and portfolio management — because efficiency is a core driver of stronger financial results.

2) Lowering funding costs responsibly (without compromising risk discipline)

As our governance, transparency, and reporting maturity continue to strengthen, we reinforce confidence in the group. Over time, this creates the foundation to reduce funding costs and lower interest rates to our investors.

3) Upgrading risk management tools and monitoring

We will continue to invest in risk management improvements, including:

-

sharper early-warning indicators and monitoring routines,

-

more granular originator performance tracking,

-

enhanced collection workflows and data feedback loops,

-

stress-testing assumptions and portfolio concentration controls.

4) Even clearer investor communication

A stable marketplace depends on informed investors. In 2026, we aim to make performance, risk, and operational updates even easier to follow — with clearer reporting formats, more context around key changes, and continued openness around governance and group development.